Stocks weaken; APPL and AMZN break to record highs after hours

* Dollar climbs on higher Treasury yields as yen dives post-BoJ

* S&P 500, Nasdaq struggle as Meta, Microsoft fall on AI spending concerns

* Gold demand extends after US-China summit

* ECB policymakers prepare for December showdown on inflation, rates

FX: USD built on the Fed’s hawkish cut and positive Trump-Xi meeting as the index tested resistance at 99.57/51, while the swing high from August sits at 100.25. Odds of a December rate cut actually perked up from 70% to around 77% as Treasury yields gave back some gains intraday. An unusually divided FOMC and the dearth of data cloud the outlook, with Powell quite understandably wanting some policy wiggle room over the coming weeks.

EUR moved lower for a second day as it tested the early October lows around 1.1542. The ECB meeting was a nothingburger as suggested in our Week Ahead. Officials kept rates unchanged at 2% for the third meeting in a row with policy still ‘in a good place’ and a data dependent stance appropriate. There is less than a 50% chance of further easing by July 2026. EZ GDP was lifted by better than expected French growth.

GBP sold off again as it moved further away from the 200-day SMA at 1.3241. But cable bounced off the August low at 1.3141 along with a major Fib level, after dipping to levels last seen in mid-April. The November budget continues to occupy markets as gilt yields find support, having tumbled in recent weeks. The next major support is the midpoint of this year’s rally at 1.2941. Markets see around a 60% chance of a December BoE rate cut.

JPY dramatically underperformed as it the major broke to the upside through previous strong resistance above 153. The BoJ left rates unchanged as expected, but Governor Ueda was relatively dovish (‘no pre-set idea about timing of next rate hike’), even though many economists expect a rate hike by year-end. We have a minor fib (78.6%) of this year’s decline at 154.81 as next resistance. Expect more verbal intervention, especially after US Treasury Secretary Bessent earlier this week called for speedier policy normalisation to avoid weakening the currency too much.

AUD traded around the 50-day SMA at 0.6559. The US/China trade truce was pretty much as expected so had already been baked into prices. CAD gave back recent gains after prices bounced off the 50-day SMA at 1.3896 and moved above the 200-day at 1.3947. Wednesday’s BoC meeting may have signalled that its easing cycle is done, but trade policies still haunt economic activity amid the ‘structural’ shift.

US stocks: The S&P 500 lost 0.99%, closing at 6,822. The Nasdaq moved lower by 1.47% to settle at 25,735. The Dow Jones finished at 47,522, down 0.23% on the day. Most sectors were red, with Consumer Discretionary, Communications and Tech all underperforming, with just Real Estate, Financials, Healthcare and Consumer Staples outperformed in the green. Meta tumbled over 11% after its one-off charge hit EPS and investors remain unconvinced with Zuck’s bet all in on AI personal superintellingence. Amazon reported after the US close with revenues up 13% on strength in cloud computing amid booming demand for AI. The shares rose over 13% in after hours trading. Apple jumped over 4% after its results call gave a bullish call for its crucial holiday sales period powered by strong smartphone revenue from its latest iPhone 17 line-up. It forecast total revenue growth nearly more than double analyst of estimates of 6%.

Asian stocks: Futures are mixed. Stocks were also mixed after the hawkish Powell press conference, BoJ meeting and Trump-Xi meeting. The ASX 200 was muted amid a lack of top tier data. The Nikkei 225 made a new high but swung between gains and losses with focus on the BoJ meeting. The Hang Seng and Shanghai Composite were subdued as markets took in the ‘12 out 10’ Trump-Xi meeting.

Gold rebounded off the midpoint of the September low to record high at $3,925 as it halted a four-day losing streak and closed above $,4000.

Day Ahead – EZ Inflation, Canada GDP

In the absence of the Fed’s favoured inflation gauge, core PCE due to the government shutdown, we get inflation data out of the eurozone. It is forecast to tick down two-tenths to 2% and the core one-tenth lower to 2.3%. Recent countrywide inflation data has been mixed with Spanish hotter than expected, but German state figures pointing to cooler price pressures. Broadly, the underlying inflation picture remains relatively stable, which matches current ECB policy which isn’t set to move again until well into next year.

Consensus see Canada GDP for August flat, two-tenths lower than the prior month. Growth contracted 1.6% in the second quarter of 2025 and the BoC predicts it will be weak in the second half of this year too. US trade actions are having a major impact on the targeted sectors that include steel, aluminium and lumber. CAD risks are tilted to the downside if there is a further deterioration in trade relations.

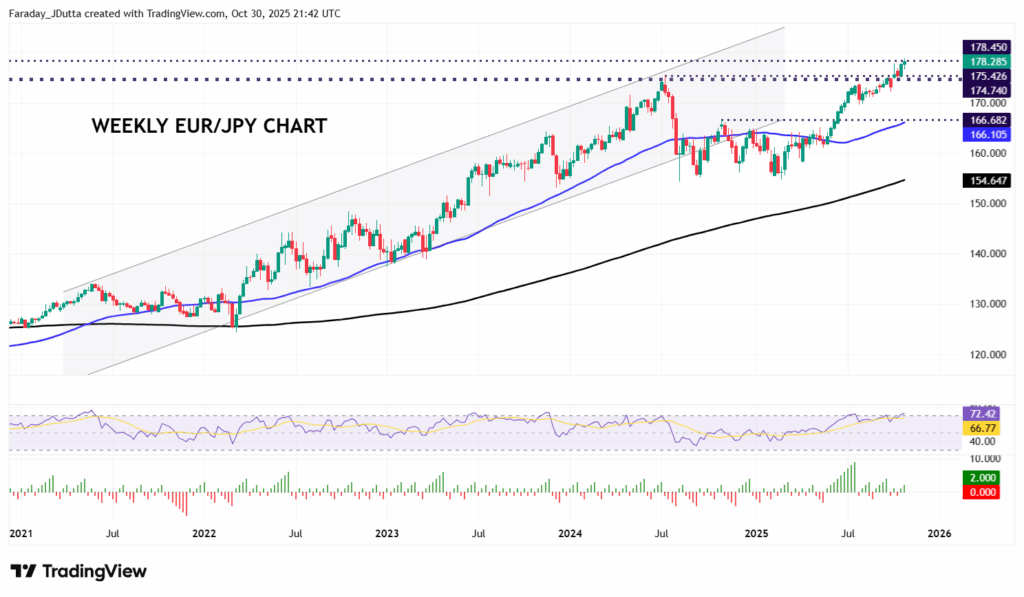

Chart of the Day – EUR/JPY hits fresh multi-year highs

This popular pair broke to the upside in June through the prior October 2024 swing high at 166.68 with nine consecutive weeks of gains. That took the cross to just below the long-term top from July 2024 at 175.42. A modest period of consolidation which stayed above 170 was bullish and has seen prices tap the 50-day SMA as support which now sits at 174.44. The Takaichi trade and a softer yen saw another decisive break north though that July level and above the 1992 high into multi-decade new peaks. There’s a monthly high from the late 1990s at 178.45 ahead of early 1990 levels above 180.