USD rally stalls despite hot data as stocks rebound

* US services activity accelerates at fastest pace since February

* Dollar holds near five-month high as data supports

* Stocks climb as tech shares rebound, Treasury yields jump

* GBP recovers only slightly ahead of BoE meeting

FX: USD consolidated its recent move higher printing a small doji candle as it bumped up into the 200-day SMA at 100.38. Risk sentiment picked up again but the dollar stayed above the 100 handle. The US shutdown is likely to be the longest on record and may now have a bigger economic impact and hurt activity going forward. The latest ADP data beat estimates, printing at 42,000 versus estimates of 28k. ISM Services also came in better than expected at 52.4 against expectations of 50.8 and prices paid hit a three-year high. There was only a muted market reaction to these numbers.

EUR printed a very small doji candle after it hit levels last seen in early August. Final eurozone services and composite PMIs offered modest upside surprises from the first estimates, while still remaining just in expansionary territory just above 50. Germany’s readings were slightly stronger in the mid-50s while France’s remained in contraction likely owing to the recent domestic political upheaval.

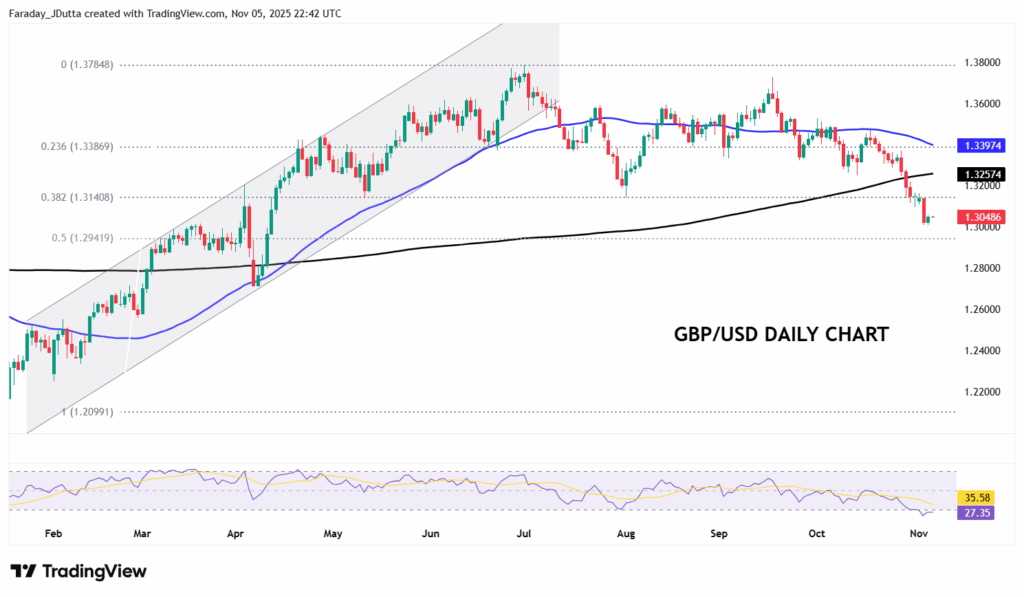

GBP perked up modestly just above the psychological 1.30 level but remains oversold ahead of the BoE meeting. See below for more details. The Budget also remains a key focus with the OBR estimates for productivity and the chance of an even greater fiscal shortfall being watched closely.

JPY strengthened below 153 before losing all its gains and the major closing above 154 as risk sentiment mildly improved. There is a minor fib (78.6%) of this year’s decline at 154.81 as next resistance. Sentiment is the driver of the yen now with technicals key for upside on the major chart.

AUD fell to 0.6458 before closing higher on the day. CAD softened with the major printing a new high at 1.4140 before closing very mildly positive on the day. The 50% retracement of the Feb/Jun decline sits at 1.4165.

US stocks: The S&P 500 added 0.37%, closing at 6,796. The Nasdaq moved higher by 0.72% to settle at 25,620. The Dow Jones finished at 47,311, up 0.48% on the day. Communication Services and Consumer Discretionary led the gainers, up over 1% while only three sectors were in the red – Consumer Staples, Real Estate and Technology. AMD beat on EPS and revenues and gave a solid outlook while Arista Networks offered weaker than expected guidance signalling a slowdown in revenue growth. Tesla reversed Tuesday’s losses ahead of its AGM where shareholders will vote on CEO Elon Musk’s $1tn potential pay package.

Asian stocks: Futures are mixed. Stocks were muted after losses in tech on Wall Street hurt performance. The ASX 200 was rangebound with financials and defensives supporting the broader market. The Nikkei 225 fell sharply and back near to 50,000 as tech losses hit the tech-laden index. The Hang Seng and Shanghai Composite were mixed as they pared losses on mixed PMI data.

Gold retraced some of Tuesday’s losses as it steadied just below $4,000, though Treasury yields ticked higher with the 10-year yield breaking above its 50-day SMA around 4%.

Day Ahead – Bank of England Meeting

The MPC is predicted to keep the Bank Rate unchanged at 4%, with around a 31% chance of a 25bps rate cut. The vote is likely to be split 6-3 in favour of keeping rates on hold, though some BoE watchers think it’s on a knife edge and could be a 5-4 vote with Governor Bailey having the deciding decision. The issue between the doves and hawks centres around recent inflation data that printed softer than expected, along with cooler wage growth. But it still remains sticky with the headline near double the bank’s 2% target. A weaker growth outlook continues, although the big kicker is probably the November budget which policymakers may want to see before acting.

Chart of the Day – GBP/USD oversold

Looking beyond November, the September CPI report added to expectations of a cut in December, with such an outcome currently priced at near 70%. The key question is what guidance the MPC gives and if it signals a December rate cut. We note for the first time, this meeting will see a summary of individual member views in the minutes, which are released alongside the decision. If the bank holds onto its hawkish summer narrative on sticky inflation concerns, sterling may get a short-term bounce.

But GBP has had a tough time in recent weeks and sunk to six-month lows on Tuesday on the back of Chancellor Reeves’ latest fiscal announcements. The prospect of fiscal tightening – possibly income tax rises alongside household energy tax cuts – will likely cement a cut at the final BoE meeting of the year. The midpoint of this year’s rally sits at 1.2941, the 38.2% Fib level at 1.3140 and the 200-day SMA at 1.3257.